10 year balloon mortgage calculator

This usually means you must refinance sell your home or convert the balloon mortgage to a. Use this Balloon Mortgage Calculator to discover how much.

Balloon Balance Of A Loan Formula With Calculator

Use this balloon mortgage calculator to view the change in principal over the life of the mortgage.

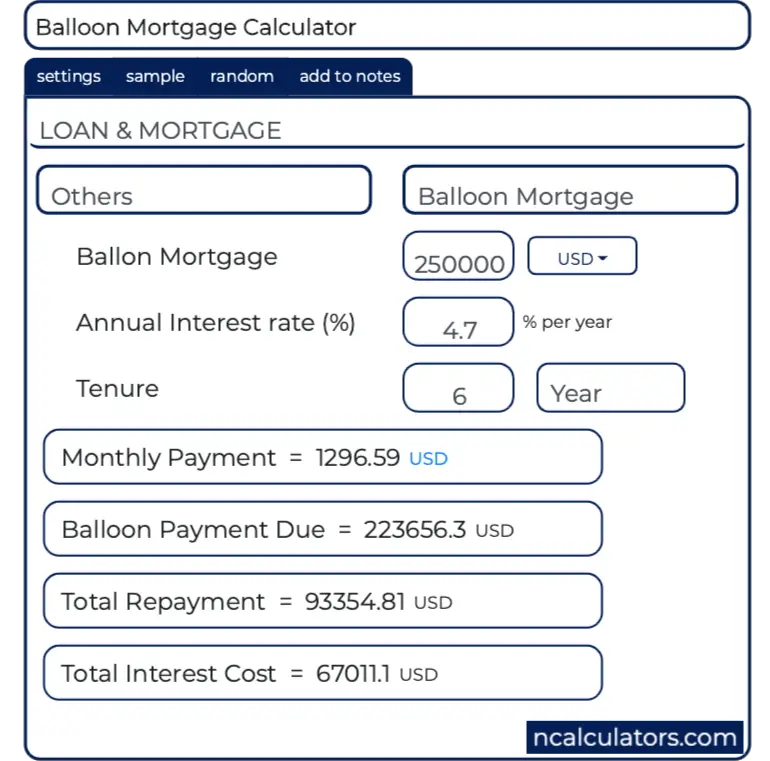

. It will also help you structure a mortgage to meet your specific needs. The key disadvantage of the balloon mortgage is the balloon payment due so the borrower usually has to refinance or otherwise find a way to pay the balloon payment. Now to calculate the balloon payment amount with the balloon due after six years set the calculator as follows.

To use this balloon mortgage calculator enter the following. Loan amount 100000. They often have a lower interest rate and can be easier to qualify.

Interest Payment Interest rate x. Mortgage Balloon Payment. The following table lists.

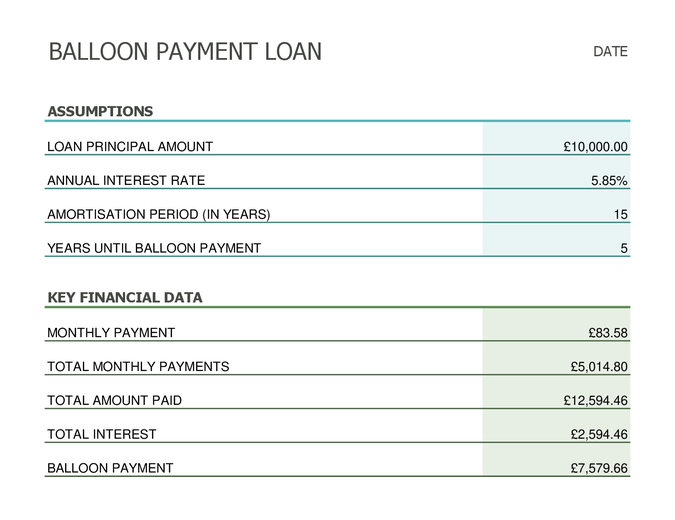

You can use the following calculators to compare 10 year mortgages side-by-side against 15-year 20-year and 30-year options. Using the Balloon Loan Calculator. After filling our balloon payment calculator with the information in this example we will receive all the necessary details immediately.

Historical 30-YR Mortgage Rates. Balloon This calculator enables borrowers to quickly see their estimated monthly loan payments for a balloon loan along with how much they will owe in a lump sum payment at the end of the. Most balloon loans are typically for a 5 or 10 year repayment period with a 30 year.

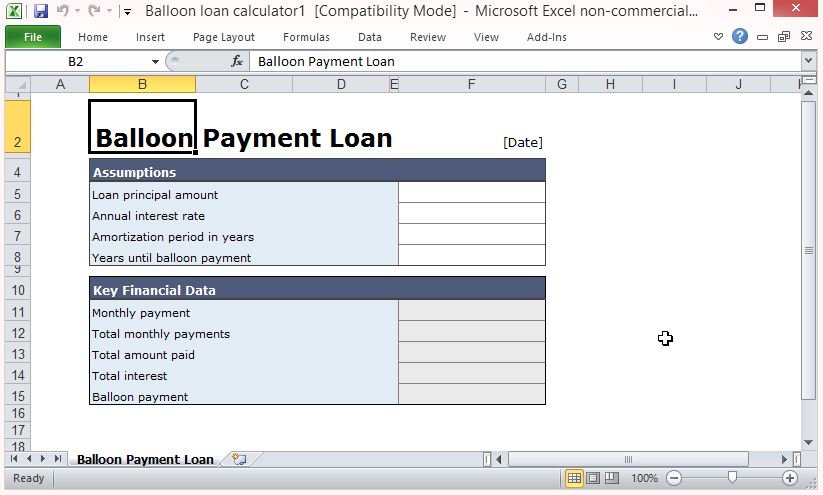

This mortgage calculator with balloon provision will not only calculate the final balloon payment. If you do not know the final balloon payment then enter ther loans amortization term in years. Enter the total value of the property or item being purchased.

A balloon mortgage is usually rather short with a term of five to seven years but the payment is based on a term of 30 years. Enter the amount that will be. If you are unsure that you will be able to handle the large payment at the end of the loan term dont apply for this mortgage.

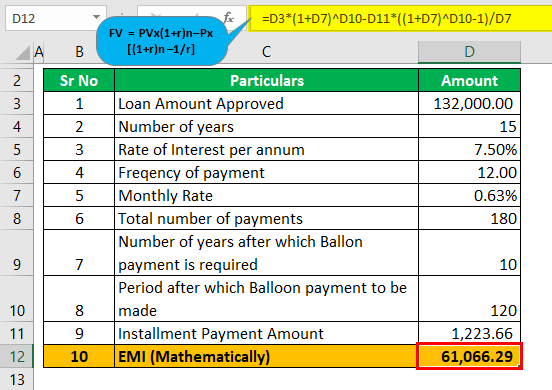

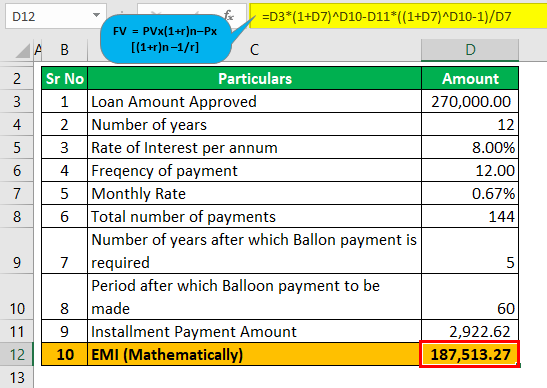

FV PV 1r n P 1r n 1r The rate of interest per annum is 75. They often have a lower interest rate and can be easier to qualify. The Balloon Loan Calculator assumes an amortization period of 30 years that is the monthly payments are based on a 30-year payment schedule without.

We can use the below formula to calculate the future value of the balloon payment to be made at the end of 10 years. Loan Balance after Length of Balloon Period Interest 12859046 12795071 63975 84 Previous Number of Monthly Payments 1 each month until Balance 0 Monthly Payment. A balloon mortgage is usually rather short with a term of five to seven years but the payment is based on a term of 30 years.

Click Calc and this is the balloon that will be due in the final month of. Based on 30 years. 49 rows A ten year adjustable rate mortgage sometimes called a 101 ARM is designed to give you the stability of fixed payments during the first 10 years of the loan but also allows you to.

Balloon Loan Calculator Single Or Multiple Extra Payments

Balloon Mortgage Calculator Hot Sale 51 Off Www Ingeniovirtual Com

Amortization Schedule With Balloon Payment Using Excel To Get Your Finances On Track Udemy Blog

Download Free Balloon Loan Payment Calculator In Excel

Balloon Loan Calculator Single Or Multiple Extra Payments

Balloon Mortgage Calculator

Free Interest Only Loan Calculator For Excel

Free Balloon Payment Excel Template

Balloon Mortgage Calculator Hot Sale 51 Off Www Ingeniovirtual Com

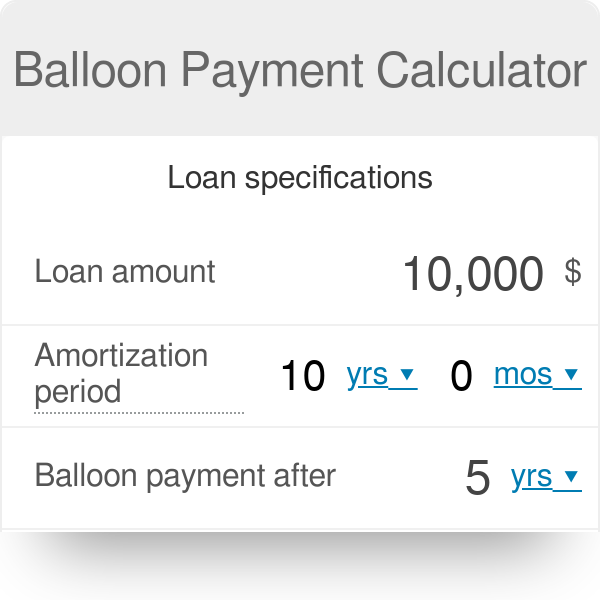

Balloon Payment Calculator

Balloon Mortgage Calculator How To Calculate Balloon Mortgage

Balloon Mortgage Calculator Hot Sale 51 Off Www Ingeniovirtual Com

Balloon Loan Payment Calculator

Balloon Loan Calculator Single Or Multiple Extra Payments

Free Balloon Loan Calculator For Excel Balloon Mortgage Payment

How To Calculate A Balloon Payment In Excel With Pictures

Mortgage Calculator With Balloon Financial Calculators Com